New research shows Americans are cutting back on so-called “guilt tipping” in 2025, spending 38% less than they did a year ago. The drop comes as higher living costs push consumers to resist pressure from digital point-of-sale screens that suggest — and sometimes guilt — them into tipping.

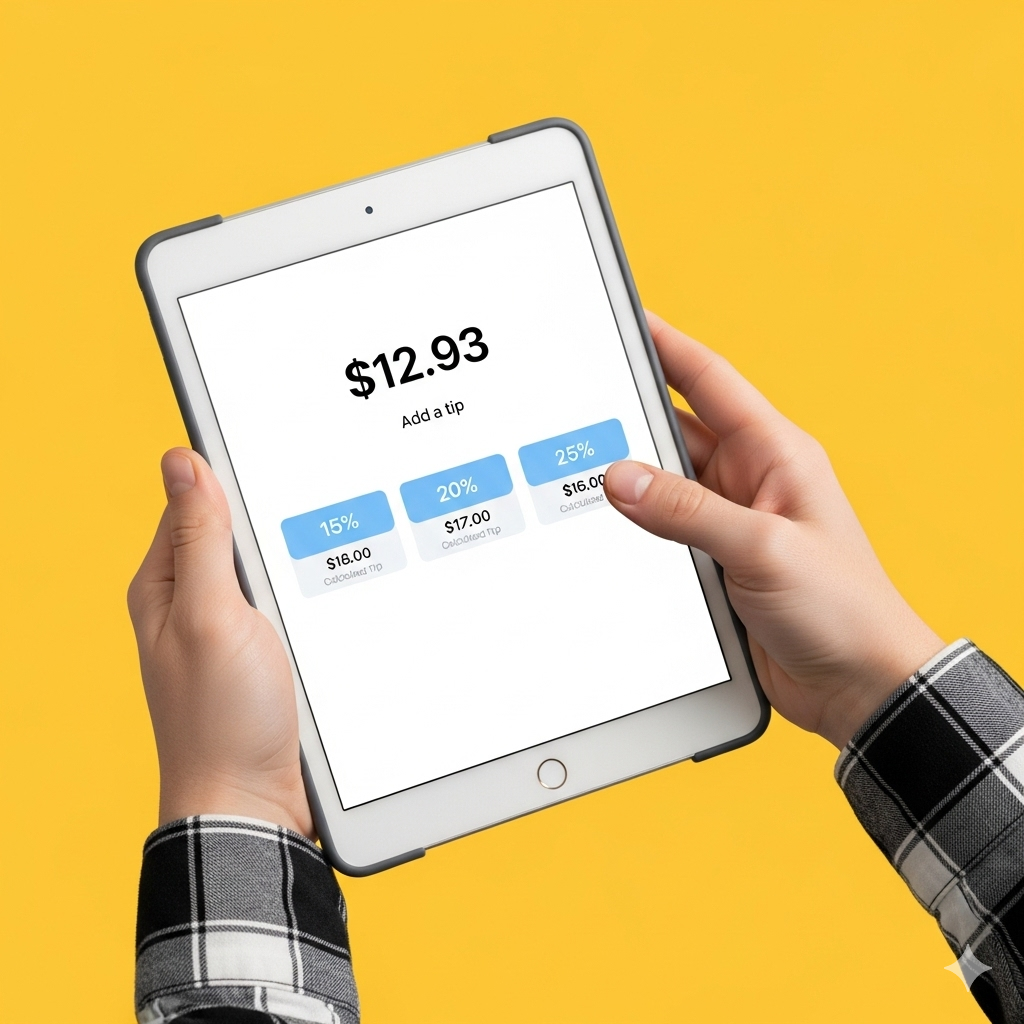

The term refers to the uncomfortable feeling many experience when asked to tip, even when service may not warrant it. Instead of being a reward for good service, it has often become a way to avoid social awkwardness. According to Talker Research’s latest study, the average person gives $24 more per month than they believe is fair, simply because of that pressure.

That “guilt tax” adds up to $283 per year in 2025, still a hefty sum but far below last year’s $450. The study, which surveyed 2,000 people, found respondents now tip out of guilt just over four times a month, compared to more than six times per month in 2024.

About one in five participants said they “always or often” tip more than they’d like due to guilt, though nearly 30% said they rarely or never feel that way. A growing share of Americans are also noticing higher preset tipping prompts on screens, with 37% pointing to rising suggested percentages. Nearly half had already noticed this trend last year.

The cost-of-living crunch is shaping consumer behavior, with 45% saying they’ve cut back on tipping altogether and 22% admitting they now tip less across the board. Most believe employers should be responsible for paying workers a fair wage instead of shifting the burden to customers. Only 11% said they tip more now, with nearly half of that group doing so to support service workers.

The findings arrive just weeks after the One Big Beautiful Bill Act (OBBBA) was signed into law on July 4. The measure allows tipped workers in more than 60 occupations to deduct up to $25,000 in tips from their taxable income between 2025 and 2028. Eligible positions include wait staff, bartenders, cooks, dishwashers, cafeteria attendants, bakers, and hosts — many of whom rely on tips as a major portion of their earnings.

The new law could ease some financial strain for service workers. But for consumers, the trend is clear: guilt tipping is losing its grip.